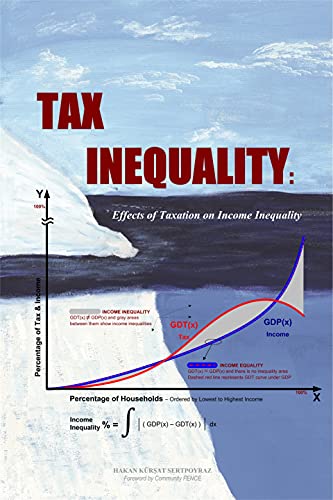

Tax Inequality

Effects of Taxation on Income InequalityThe problem is not income inequality, the problem is tax inequality. Income inequality is a natural condition; even the twins raised together have different incomes.

People have different capabilities and talents, grow up in different societies with different cultures, achieve different levels of education, and have different professions in different economic sectors. Nonetheless, they work in the same economy and the same country.

This book explains a new method to evaluate the fairness of income distribution. Income equality is better not be defined by only looking at the income levels of households―the income share from the gross domestic product (GDP) of a country. The household income share from GDP includes all type of taxes. Therefore, to make a fair income evaluation, the tax share on the household incomes should be taken into account―the tax burden share from the gross domestic Tax (GDT). The income equality definition in the book says, "Income equality in a country means households have same percentage share from GDP and GDT."

The tax burden is not only the tax on income (e.g. income tax, social security contributions, unemployment tax.) And, the tax on net income is not only sales tax or value added tax (VAT) much more is embedded into the price of products become households expenditures.

Hakan Kürşat Sertpoyraz

- Calculations for Chapter 3 Evaluating the Fairness of Household Income

- Calculations for GDP by Tax Approach (VAT returns)

- Calculations for GDP by Tax Approach (Tax returns)